Clover and Square are established players in the point of sale (POS) market.

Clover POS is owned by Fiserv, a leader in the payment processing industry, and has been around since 2013. Square, co-founded by Jack Dorsey and Jim McKelvey in 2009, is also a long-time industry favourite, known for its ease of use and intuitive design.

In this article, we’ll compare these POS systems based on their features, performance, support, and pricing structure, and find out the best fit for your business.

Features

As a feature wise comparison, we look at three aspects of Clover and Square POS—integration, ease-of-use, and their ecosystem.

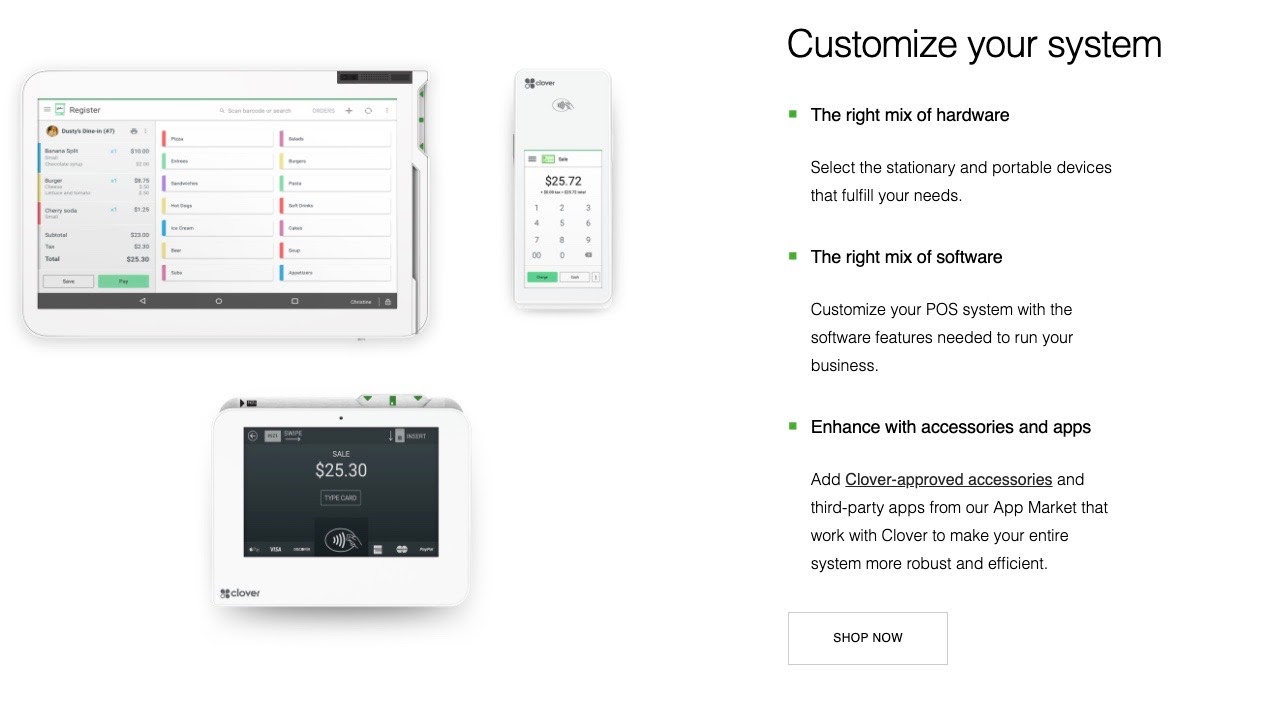

The fundamental difference between the two systems lies in how their hardware integrates with the software. When you purchase Clover, the device kit comes along as an all-in-one package with no need for additional hardware.

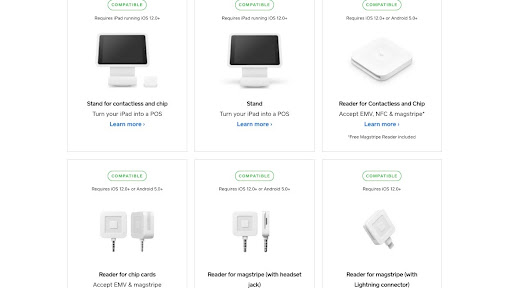

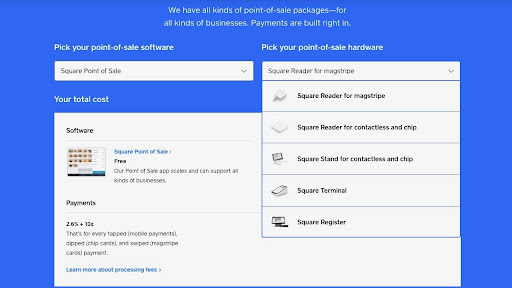

With Square point of sale system, you’ve the option of choosing between its proprietary hardware (e.g., Square Terminal, Square Register) or directly installing its POS app on your iOS or Android device. You also get a free magstripe reader and further, you can add accessories such as cash drawers or bar code scanners.

Who wins here depends on what you want. The tight hardware and software coupling in Clover frees you from worrying about add-on purchases or setup effort. But if you run into any hardware issues, you can’t switch to just another Apple or Android tablet—you’ve to replace your Clover device.

This one is a leveller. Square POS comes with a free card reader that you can plug into any mobile device, and get started instantly. The POS app has a neat UI and a virtual terminal that lets you store credit card details, a feature loved by repeat customers.

Clover, too, is known for its easy-to-use software, aesthetic design, and intuitive navigation. Its menu options are clearly labelled making it easy for any newbie to get comfortable with it in no time.

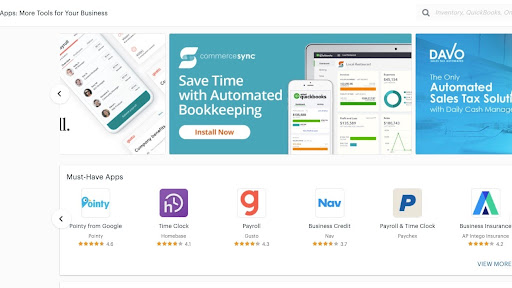

Clover and Square have their own robust ecosystems, although what they bring to the table varies. Clover has an exhaustive app marketplace. Whether you need inventory, reporting, or employee management functions, you’ve an app for everything.

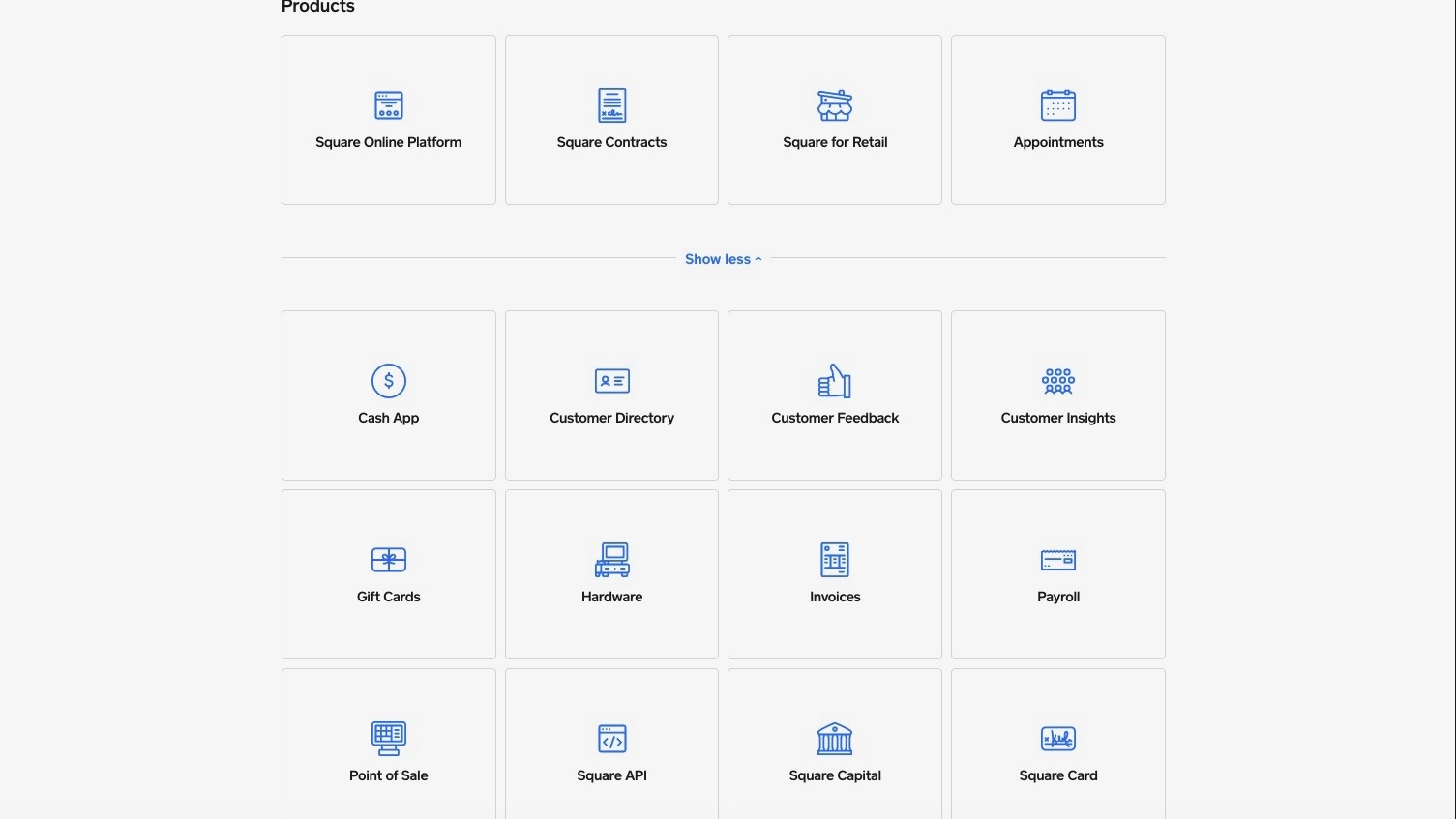

Square, however, is much more than just a payment processing and POS system.

It offers a free eCommerce store that displays product listings and a Square Card that lets businesses access their funds immediately. Square Online, a self-service feature, allows businesses to print out QR codes on tables, menus, etc. for customers to scan payments on their own.

Pricing was very competitive and the Clover terminal itself is very modern and easy to use, great value for money. Not often I deal with companies and feel like I have made a friend once the deal has been done.

G.Barber, Jurassic Building Supplies

Clover is an excellent integrated POS solution with a wealth of app choices that lend you functional flexibility, but you need to invest time and effort to find the right apps for your business. Square POS stands out for its wider hardware compatibility and a long array of distinguishing features.

Performance

As Clover bundles its POS hardware and software together, they work seamlessly together without any issues. As it’s cloud-based, you can access the POS software from any Clover device. All you need is an internet connection.

Even if you have an unstable network, you can continue processing your payments as data is queued and backed up on the local device and then synchronized when you go online.

Square is configured to work in offline mode, which is ideal when you want to set up mobile kiosks with an unreliable internet connection. Another plus for the brand is that hardware compatibility doesn’t matter for Square Register and Square Terminal. Both are standalone devices, but the POS app can run on devices with iOS 12.0+ or Android 5.0+.

Both POS systems score well in performance and stability as well as the speed with which you can set them up and get started.

Support

One factor about Clover to be mindful of, is its chaotic purchasing market. The purchase of a Clover POS system is tied to a merchant account such as Bank of America or Citibank or a merchant reseller.

When you have a service issue, your first line of contact would be your bank or reseller. But the technical support for the POS software and hardware would come from Fiserv.

This dual accountability makes it messy with issues often not resolved to satisfaction. You'll need to research the service quality of the specific bank/reseller, but overall reviews of Clover’s support have been less than favourable.

Liked this POS comparison review? You might also like our Quickbooks POS vs. Shopify POS and Apple POS vs. Android POS system comparisons.

Of course, there is the odd raving review of the service, and Clover seem to be very prompt in helping resolve any issues highlighted in negative reviews.

Square point of sale has a different kind of support issue to be aware of. The company’s stringent fraud protection policy can result in termination or suspension of your account and freezing of your funds until further documentation is provided.

Square isn’t transparent with what leads to a red flag—it could be a higher than usual transaction volume or per transaction amount. Although in many cases, businesses have been able to clear the review, this remains a concern. What this does mean though, is Square POS takes payment security extremely seriously.

Clover POS and Square POS offer ample documentation on websites and support through phone, email, and social media. As with any company, they have room for improvement when it comes to customer support and each have a few core issues should be addressed.

Pricing and plans

Clover’s POS prices vary based on whom you buy the product from. But as a general rule, they follow a 5-tier pricing plan with varying support for its hardware:

- Payments Plus at $4.95/mo

- Register Lite at $9.95/mo

- Register at $39.95/mo

- Counter Service at $39.95/mo

- Table Service at $69.95/mo

Other costs

The transaction fee is 3.5% + 10¢ for keyed transactions and varies between 2.3% + 10¢ to 2.7% + 10¢ for in-person transactions (reduces as tier increases).

Clover's POS hardware ranges from $69 (Clover Go) to $1649 (Clover Station Pro).

Square has a free version—so you can download the free POS app on your tablet but incur a fee of 2.6% + 10¢ per transaction. This gives you the freedom to play with the app interface before committing to its more advanced hardware such as Square Terminal or Square Register.

Square Stand costs $169

Square Terminal costs $299

Square Register costs $799

and they all incur a 2.6% + 10¢ per tap, dip, or swipe transaction, 3.5% + 15¢ for keyed transactions, and 2.9% + 30¢ for online transactions.

Apart from the one-time cost of hardware, there are no monthly or subscription fees. You need to factor in just the transaction fees, a factor that gives a strong boost to Square.

On the software end, you can top up the free Square POS app with Square for Retail, Square eCommerce, or Square for Restaurants, depending on your industry. This is likely to hike your costs though.

Conclusion

Overall Clover appears to cost more than Square, but that's due to its upfront pricing. If you use just the Square POS app, costs are reasonable for small and medium businesses. For large businesses, and if you want to indulge with Square’s higher end bundles, costs can escalate.

Verdict

Clover and Square are both equally viable options and they stand head-to-head on performance and support.

Square’s free version makes it ideal for smallish businesses who want to get a jumpstart without much investment. It’s also got a rich feature set considering its low pricing, and is ideal for industry-specific solutions such as for retail and restaurants.

Although Clover is more expensive than Square, you can take advantage of its basic plans if you want to start small. Its app ecosystem is a big pull, especially if you’re keen to build customized solutions.

If you’re still on the fence, find out if you’ve a preference towards tighter vs. looser hardware integration and the decision becomes easy for you.

from TechRadar - All the latest technology news https://ift.tt/3yc7kh1

via IFTTT

Comments

Post a Comment